Local, state and federal governments generate a net tax benefit of $198.3 million in Victoria, according to a recent independent taxation study commissioned by Greyhounds Australasia.

The report, prepared by market research firm IER, found the Australian greyhound racing industry generated $410.5 million in direct taxation for local, state and federal governments in 2022-23.

The primary sources of this taxation were:

- wagering or betting taxes, in terms of point of consumption tax (POCT) levied on wagering on greyhound racing product,

- taxes levied on gaming machines for those clubs and controlling bodies providing this form of entertainment to their customers

- direct income taxes on those who are employed within the greyhound racing industry in Australia

- payroll and corporate income taxes levied on ‘for profit’ wagering organisations (to the extent that it is aligned with greyhound racing activity)

- the ‘net GST’ generated by businesses operating within the Australian greyhound racing industry

- other taxes and levies such as fringe benefits tax, land tax and other wagering taxes/levies

- taxes generated from participants who spend their money in their involvement in greyhound racing

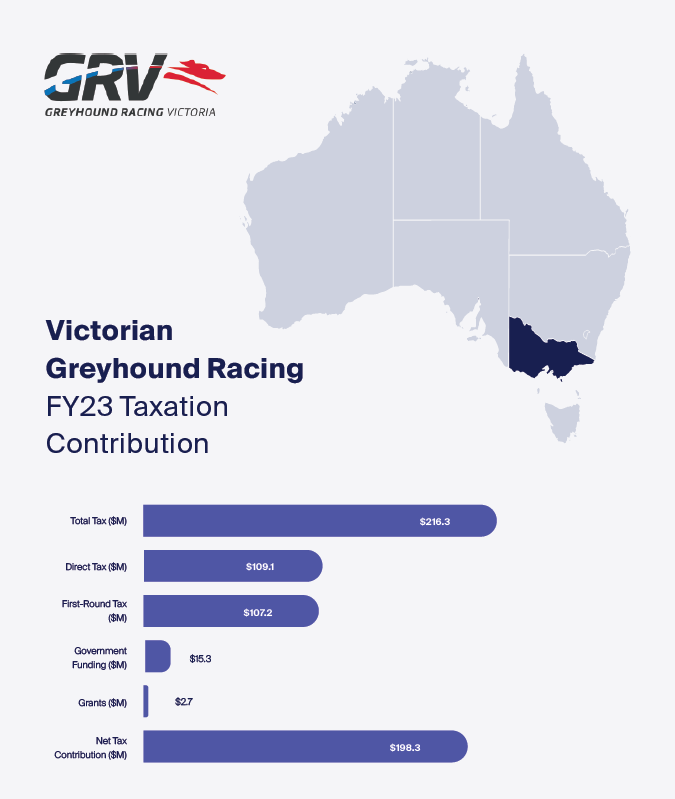

The direct taxation in Victoria was $109.1 million.

First-round taxes were also studied, representing taxes generated by businesses and operations supplying directly to the greyhound racing industry.

The supplier network involved in greyhound racing includes veterinarians and transport companies, feed merchants, sand and soil suppliers, the construction and IT industries and equipment manufacturers.

The study found Victoria generates first-round taxes of $107.2 million, taking its total tax generated to $216.3 million.

Deducting $15.3 million in government funding (GRV’s share of POCT) and $2.7 million in Victorian Racing Industry Fund grants, the net taxation impact was a benefit of $198.3 million to local, state and federal governments.

Click on the image below for the full report.